Letter Of Explanation Of Derogatory Credit | Don't leave the borrower completely on their own to write the letter. Qualifying for mortgage with direct lender. However, some are more severe and can last as long as ten years from the time of the account's last activity. A credit letter of explanation is written to give the detail of any credit application to the bank as per the rules of the concerned financial institute. If there are five derogatory items, make certain that all five.

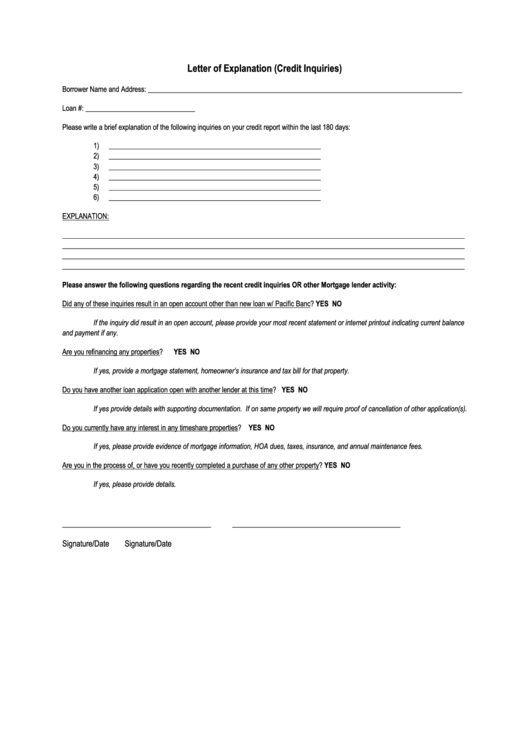

Writers should make the letter concise and only address the items the mortgage. You should clearly state what has caused. Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies. In order for us to better understand your situation, please provide us in your own handwriting, answers to the following questions. Letters of explanations for derogatory tradelines * letter of explanations will be required for the following:

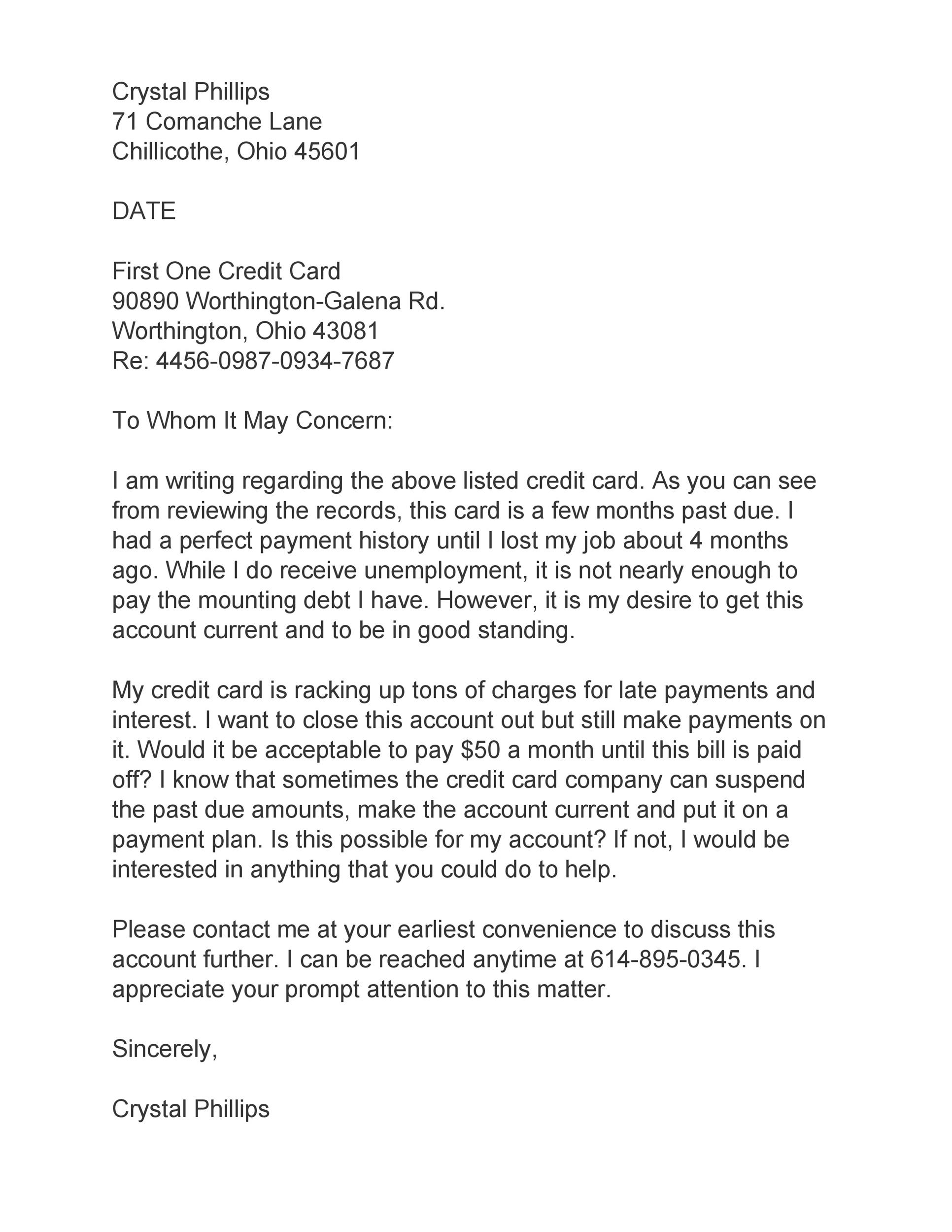

The chart below covers the different types of. Add a letter of explanation to your credit file if you feel extenuating circumstances. A creditor or lender may report negative information to the credit bureaus, which is the amount of time a derogatory mark stays on your credit reports depends on what type of mark it is. If there were extenuating circumstances that led to you becoming behind on your bills, explain what happened and. Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. _explanation of (please to the best of your ability; The term derogatory means the information is negative and will likely hurt your ability to qualify for credit or other services. The word derogatory simply means negative, so a derogatory credit item is a negative item on your credit report. Derogatory credit explanation letter note: It may also refer to other information that indicates credit risk, such as bankruptcy and public records. This demonstrates honesty and understanding of make sure that your borrower's credit explanation letter corresponds with the credit report. In order for us to better understand your situation, please provide us in your own handwriting, answers to the following questions.

There are many different letters of credit including one called a revolving letter of credit. Writers should make the letter concise and only address the items the mortgage. A creditor or lender may report negative information to the credit bureaus, which is the amount of time a derogatory mark stays on your credit reports depends on what type of mark it is. Don't leave the borrower completely on their own to write the letter. You may want to enclose a copy of your credit report with the items in question circled.

Send your letter by certified mail, return receipt requested, so you can document that the. Don't leave the borrower completely on their own to write the letter. Writers should make the letter concise and only address the items the mortgage. It is important to produce the accurate document in order to make your credit application eligible for the bank approval. Borrower letter of derogatory credit. A letter of credit is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Most derogatory marks stay on your credit report for seven years. Most loan officers still simply give the borrower a list of derogatory accounts and ask them to explain them. Sample of a credit letter of explanation. View, download and print borrower letter of derogatory credit pdf template or form online. Derogatory marks on your credit are negative items such as missed payments, collections, repossession and foreclosure. Frequently asked questions about credit scores. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.

View, download and print borrower letter of derogatory credit pdf template or form online. If there were extenuating circumstances that led to you becoming behind on your bills, explain what happened and. For instance, a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow. Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies. Confirmation and confirmed letter of credit.

For instance, a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow money. Letters of credit are often used within the international trade industry. Describe the reasons for your derogatory credit and how Derogatory credit is the result of negative credit items. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. Most derogatory marks stay on your credit report for seven years. Multiple derogatory items will also cause your credit score to drop. There are many different letters of credit including one called a revolving letter of credit. A letter of explanation is your opportunity to explain to the lender in detail why there are negative marks on your credit. It's crucial to understand the different types of derogatory items so you know how you can avoid adding any new ones to your. The chart below covers the different types of. Learn about common negative marks, how long they last and how to improve your credit. _explanation of (please to the best of your ability;

Letter Of Explanation Of Derogatory Credit: Availability of letters of credit.

Referanse: Letter Of Explanation Of Derogatory Credit

0 Tanggapan:

Post a Comment